Financial Freedom Agent

Problem and Motivation

The inequality of wealth has substantially increased in the United States in recent decades and 60 - 70% of Americans are living paycheck to paycheck. A sudden change to economic status can quickly lead to a challenge and a majority of Americans are at the edge of going down a slippery slope of being in unrecoverable debt or achieving financial freedom. In a 2019 report on the economic well-being of U.S. households, the Federal Reserve Bank determined that nearly 40 percent of U.S. adults wouldn’t be able to cover a $400 emergency with cash, savings or a credit card charge that they could quickly pay off.

Multiple studies have shown that behavior is the major reason that can help people living paycheck to paycheck. Per the book Psychology of Money, the premise is that doing well with money has a little to do with how smart you are and a lot to do with how you behave.

Financial Freedom Agent is an AI agent through a consumer app that can help automate and support a person to meet their financial goals such as saving through nudges and positive behavior reinforcement. AI can solve this since many personal budget apps are not leveraging more modern categorization models. Additionally, existing tools are not focused on an AI agent .

Minimum Viable Product (MVP)

Our MVP consists of three primary features.

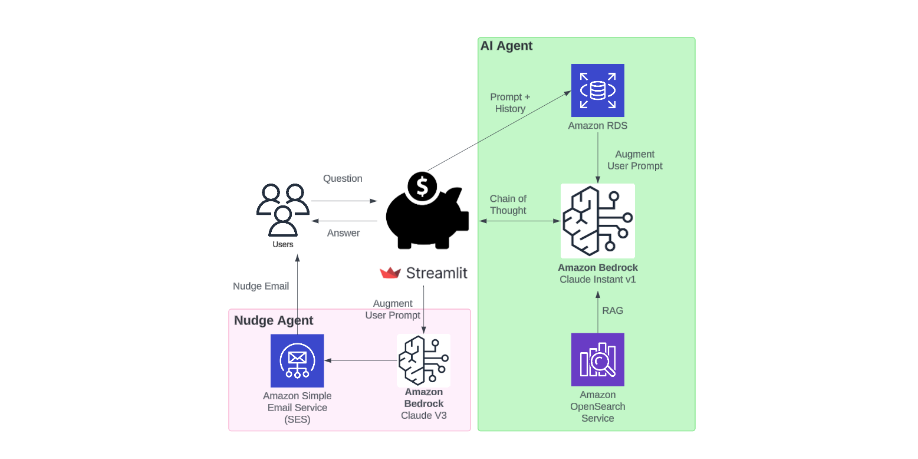

An agent interface that is easy to interact, ask questions, and get answers that are personalized with outperforming existing LLM responses. This agent will be personalized through a persona derived by a cluster of attributes. To ensure meaningful interactions, the agent will also leverage reinforcement learning to adjust intervention emails when a user is predicted to do their most spending. This will accomplish the goal of the agent being a buddy to help with positive behavior changes that a user opts into.

Automated credit card transactions and a financial budget. A significant barrier today that causes users to not be able to tackle steps to financial freedom is the limit of time to understand their costs and create a budget.

Trusted association with the app. Leveraging best practices of data privacy and ethics, the app was created with commitments of a privacy policy and no third party data sharing.

Data Source and Data Science Approach

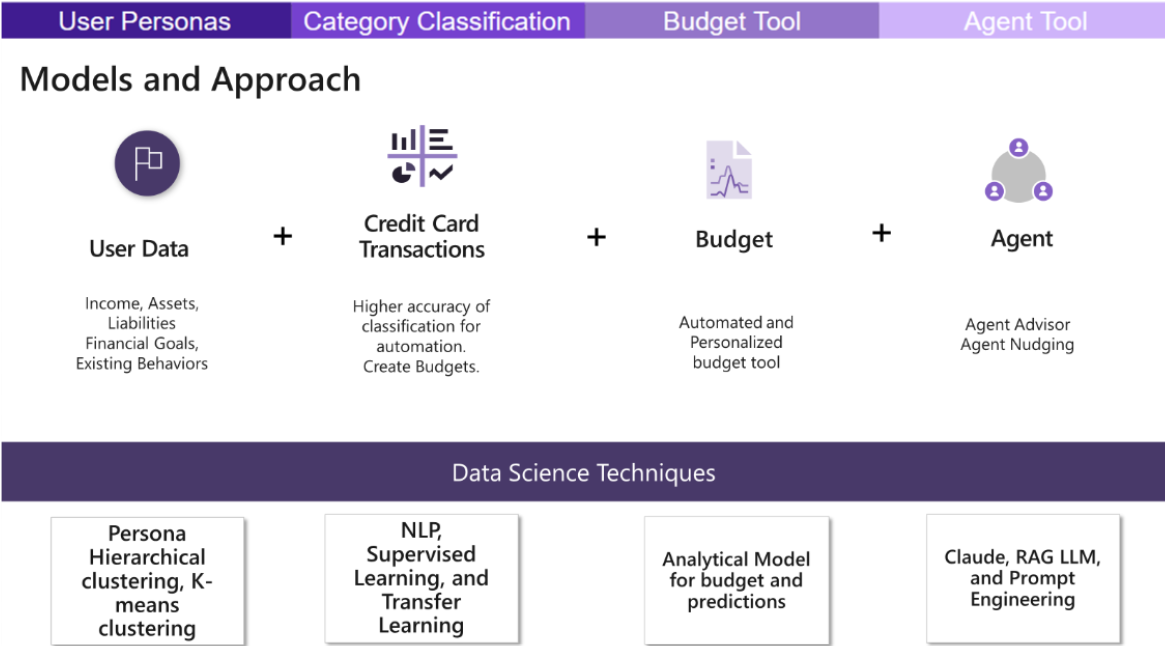

Four Core Models:

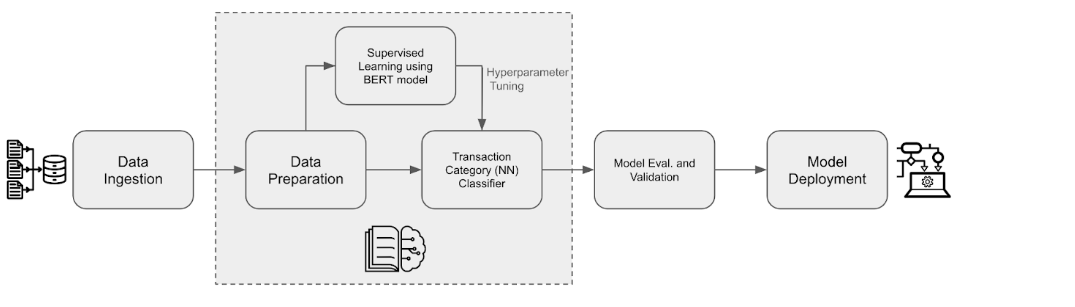

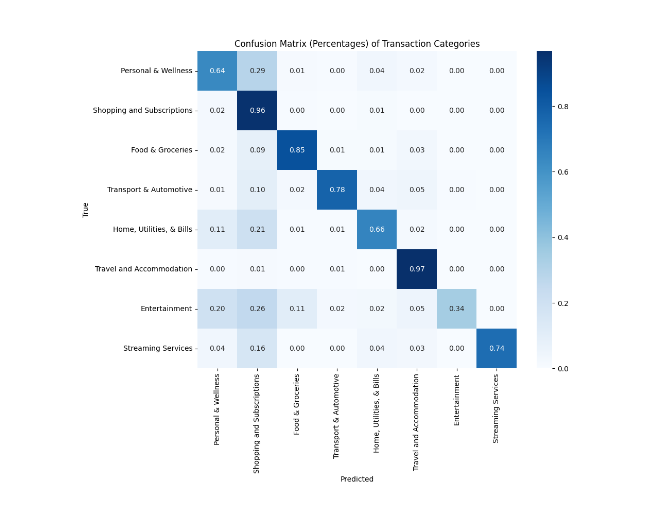

- Transaction classification model

- Our advanced classification model leverages NLP and text processing to categorize credit card transactions into 8 distinct categories with unparalleled precision. Achieving over 90% accuracy in transaction prediction, our solution offers users a clear view of their spending habits and curates recommendations to enhance their financial well-being. Tackling this issue has signified a significant stride forward in financial management and user experience. Data was collected from donated credit card transactions and a Kaggle data set.

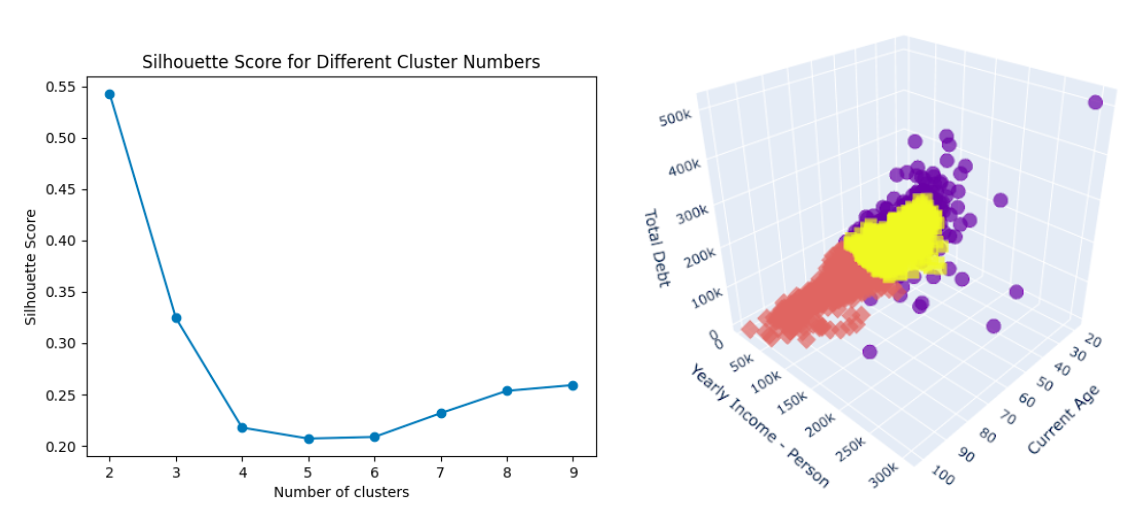

- Persona clustering model

- Our innovative k-means clustering model discerns unique user personas based on behaviors, revolutionizing the way we support low-income individuals. Using age, income, and total debt at inputs, users are grouped into one of the following personas: financially vulnerable, moderately stable, and financially stable. User personas are then passed to the AI Agent. By tailoring experiences and providing personalized analytics and support, we guide users toward achieving their spending and budgeting aspirations.

- Budget Tool

- The budget leverages an analytical model based on the outcomes of user clustering and category classification model. It begins with the User Cluster Model, which groups users with similar profiles. For each user group, we analyze historical transaction data to determine the average spending percentage across different categories. This outcome, combined with an individual's spending history, enables us to craft personalized budget recommendations for each user.

- Agent Tool

- As a starting point for the agent we evaluated foundational models with a final comparison between GPT4, GPT3.5, Claude 2, Claude 3 (released in March 2024) and Claude Instant in multiple dimensions, such as response time, cost efficiency, answer accuracy and relevance. A decision was made based on the quality of response and dependencies with the AWS infrastructure where the apps was built. In addition, AWS Bedrock provided a more secure platform compared to the public OpenAI assistance API. Claude Instant was selected for the AI Agent. Claude 3 was selected for Nudge Agent. To enhance the performance of Claude, we used RAG, prompt engineering, and few shot learning to create a more personalized agent.

Evaluation

Evaluation Metrics on Clustering Persona Model:

Evaluation Metrics on Classification Model:

Key Learnings and Impact

We were successful in creating a conceptual MVP that showed the feasibility to automate categories, personalize an agent to answer relevant questions, and create nudges via emails to show working on behalf. For future the next steps we would take are:

- Work to deploy app

- but before making it publicly accessible ensure all legal and security best practices are followed

- Connect financial institutions

- To ease upload of financial data

- To empower agent to take action for user, eg: put $10 into savings

- Enhance the Financial Advisor experience by adding more context for each user

- Transaction data

- Past conversations

Acknowledgments

Our team is grateful to our capstone professors Joyce Shen and Kira Wetzel. Their support, advice, and encouragement was instrumental in the completion of our product.

An additional thank you to professor Jennifer Zhu, who was supportive in giving us guidance and advice for our categorization model.

Thank you to Jean-Luc Jackson, Laura Pattison, and Naomi Russell for their support, testing, and feedback throughout our journey.